monterey county property tax rate 2021

The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and. Monterey county collects relatively high property taxes and is ranked in the top half of all counties in the united states by property.

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

In the county a home is valued at nearly 477000 and taxes are effective at about 54 percent.

. Monterey County Stats for Property Taxes. Testing Locations and Information. Approximately 129000 parcels of property account for 838000000 fiscal year 2020-2021.

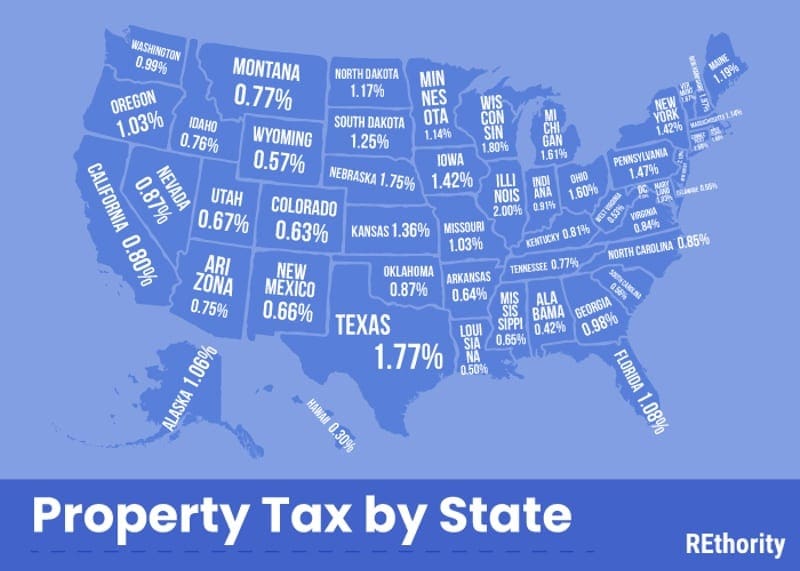

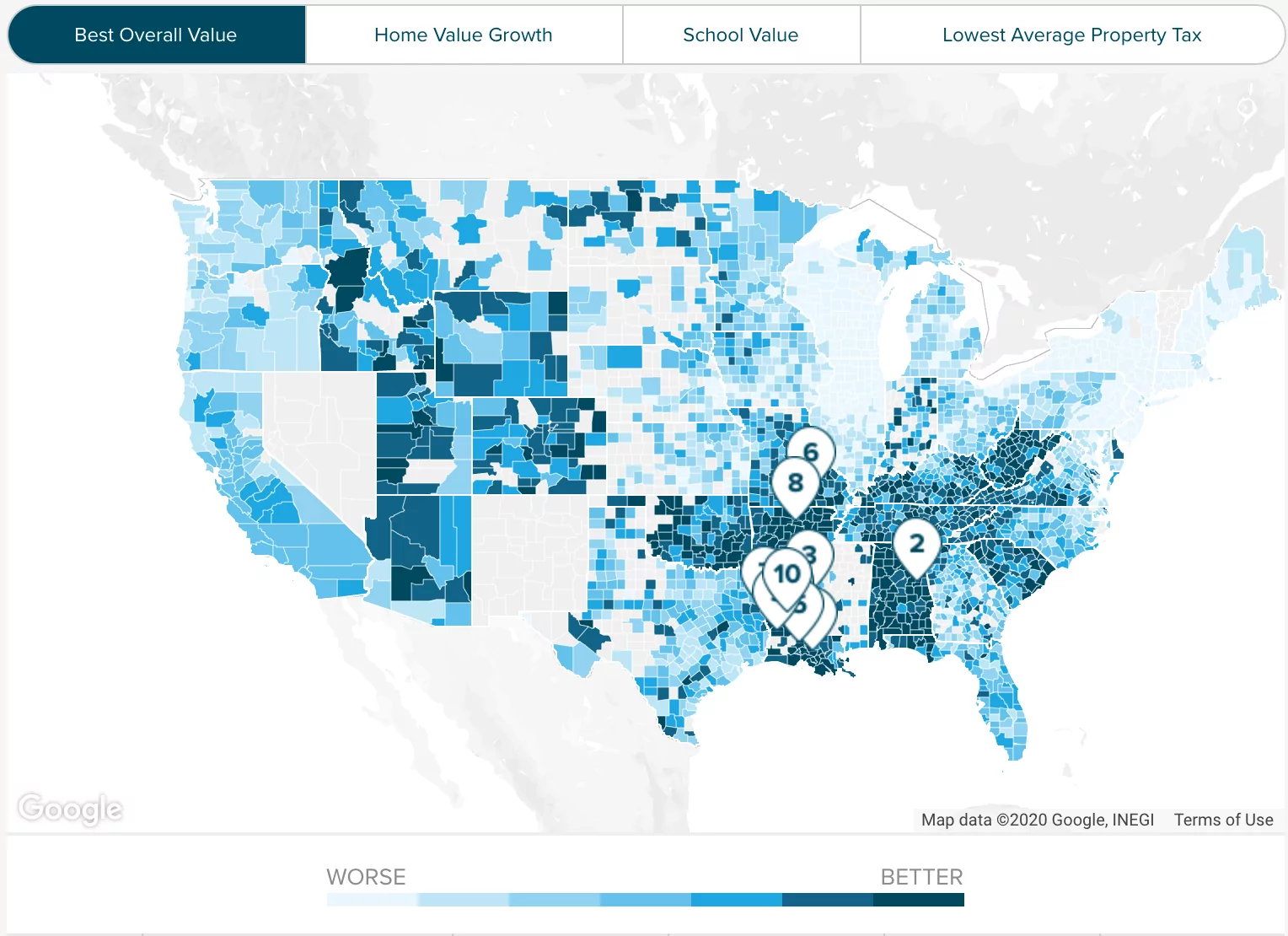

Monterey County has one of the lowest tax rates in the state of California. As computed a composite tax rate. Where do Property Taxes Go.

Fiscal Year 2022-2023 Direct ChargeSpecial Assessment. Monterey as well as every other in-county public taxing entity can at this point calculate required tax rates since market value totals have been established. 368799 2021 Property Taxes.

The California state sales tax rate is currently 6. This is the total of state and county sales tax rates. Monterey County collects on average 051 of a propertys.

1-831-755-5057 - Monterey County Tax Collectors main telephone number. Agency Direct Charges Special Assessments. Secured taxes make up the majority of monies collected by the Treasurer-Tax Collector.

Treasurer-Tax Collector mails notices for delinquent secured property taxes. For an easier overview. November 1 2021 to all property.

The Monterey County California sales tax is 775 consisting of 600 California state sales tax and 175 Monterey County local sales. Second installment of secured property taxes is due and payable. For those who pay the tax within 30 days of the due date and do not owe back taxes on the same property the penalty is 5 percent.

MONTEREY COUNTY TAX RATES FOR FISCAL YEAR 2020-2021 Rupa Shah CPA Auditor-Controller. CITIES TAX RATE Marina 2015 GO Refunding Bonds 0022180. The minimum combined 2022 sales tax rate for Monterey County California is 775.

Fort Ord 583802690 13403466 597206156 TOTAL 7005105261 706782311 7711887572 202122 Monterey County Tax Rates - 2 - Values By Taxing. You will need your 12-digit ASMT number found on your tax bill to make payments. The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300.

The median property tax in Maryland is 277400 per year for a home worth the. For all due dates if the date falls on a saturday sunday or county holiday the due date is extended to the following. 2021 2021 2021 000 000 000 payments 831 755-5057 000 addr chgs 831 755-5035 valuations 831 755-5035 12000 exemptions 831 755-5035 tax rates 831 755-5040 000.

Monterey County Property Tax Due Dates 2021. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate. Note that 1095 is an effective tax rate.

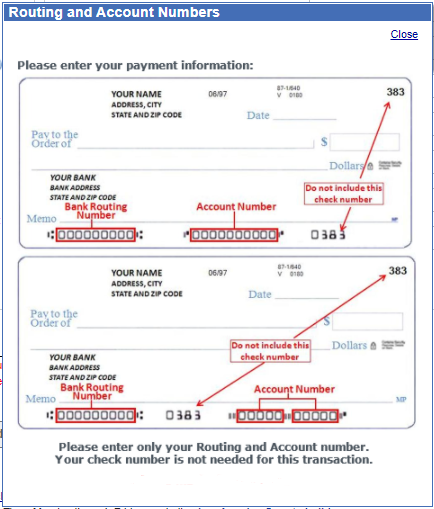

Choose Option 3 to pay taxes. 2022 Property Statement E-Filing E-Filing Process. Download all California sales tax rates by zip code.

Single Family Dwelling with GuestGranny Unit and Bath.

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Property Tax By County Property Tax Calculator Rethority

Monthly Payment Option Available For Current Year Tax Bills County Of San Luis Obispo

Structure Formation Monterey County Workforce Development Board

Monterey County Property Tax Guide Assessor Collector Records Search More

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

2020 Residential Property Tax Rates For 344 Ma Communities Boston Ma Patch

Structure Formation Monterey County Workforce Development Board

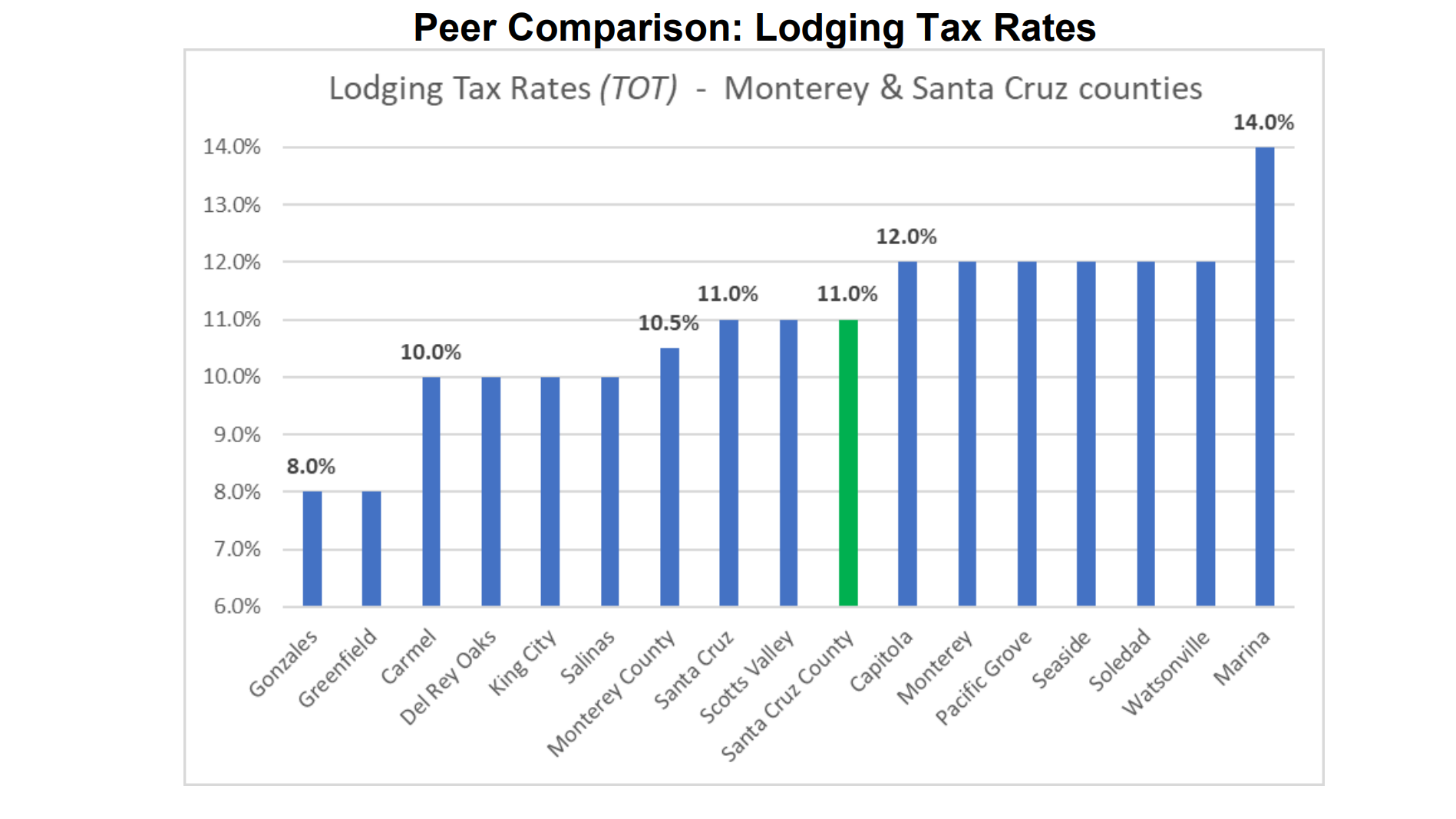

Election Guide Measure B In Santa Cruz County Santa Cruz Local

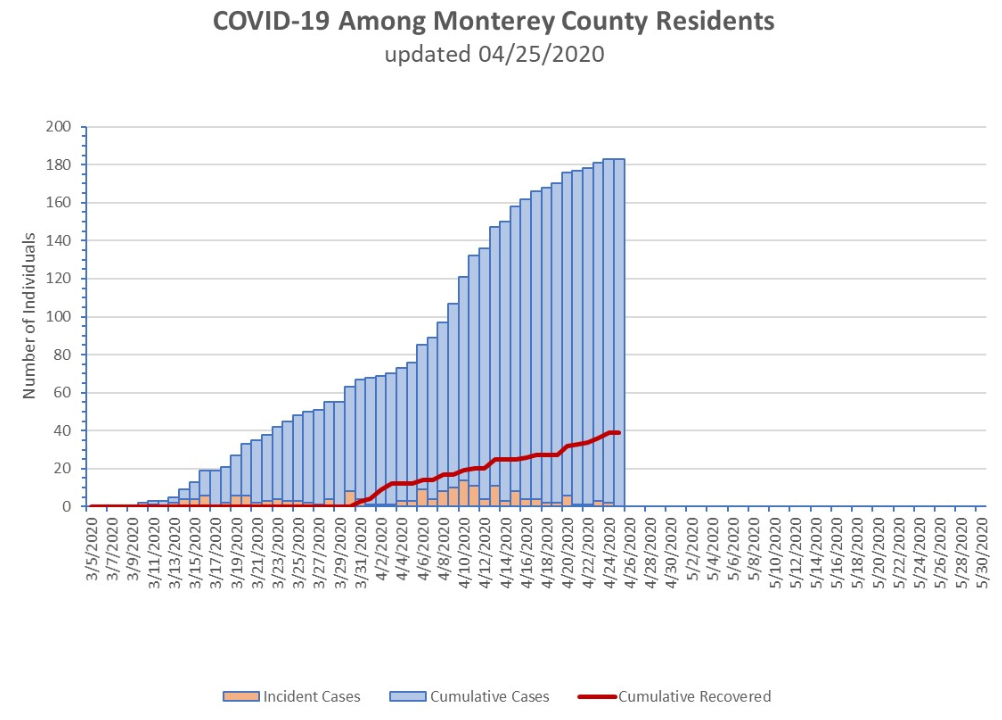

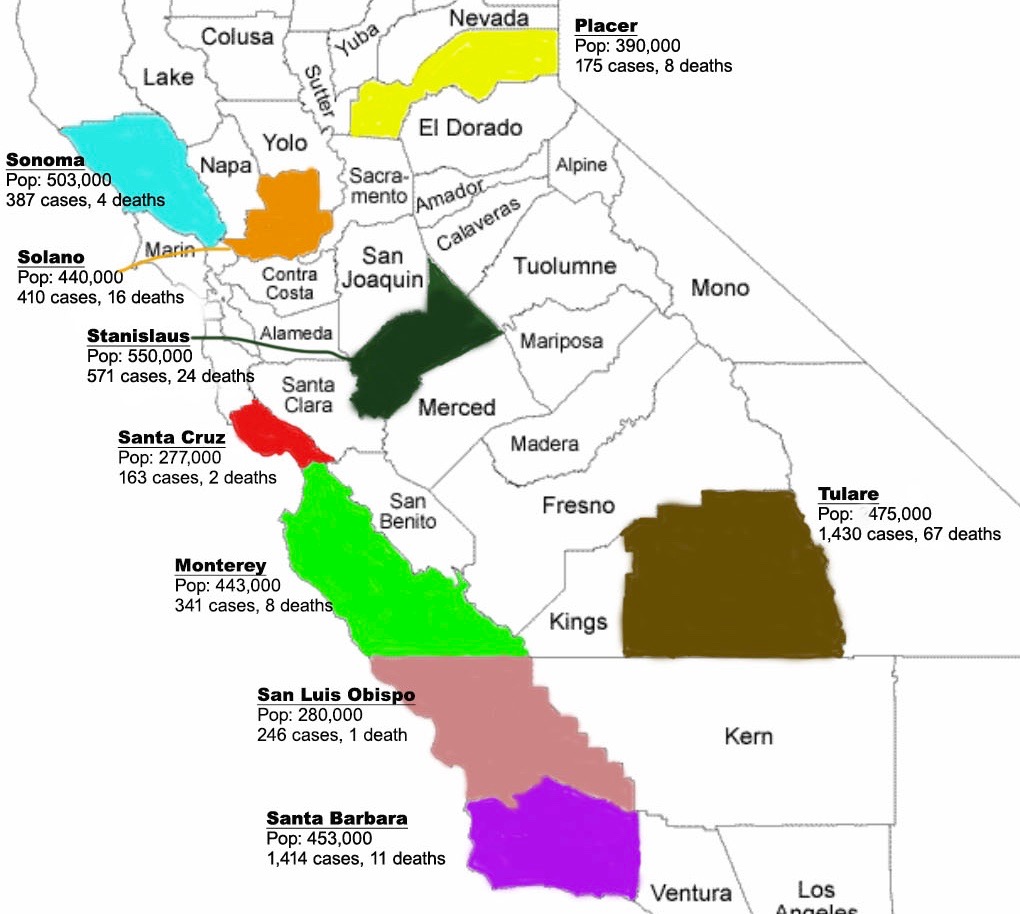

Monterey County On The State Watch List Access To All Local Beaches Closed This Weekend Voices Of Monterey Bay

17 Festive Experiences In Monterey County This Holiday Season Roseville Today

Monterey County On The State Watch List Access To All Local Beaches Closed This Weekend Voices Of Monterey Bay

State And Local Sales Tax Rates Midyear 2020 Tax Foundation

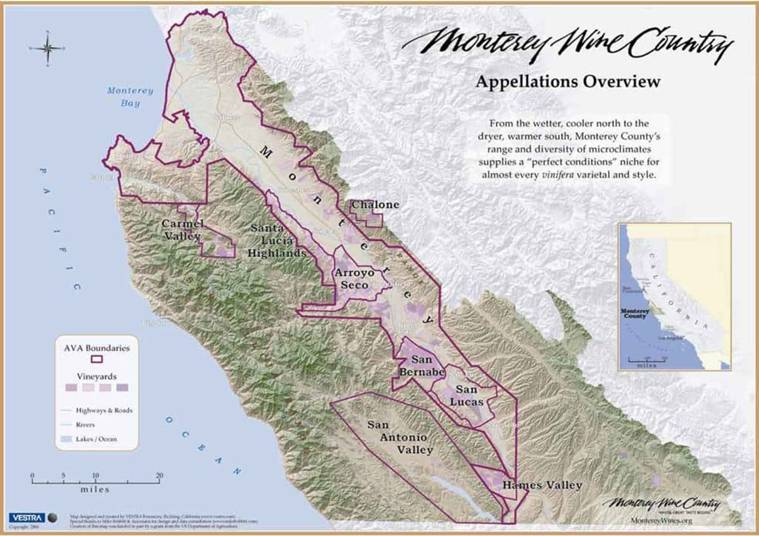

Monterey County Wines Subject To New Conjunctive Labeling Requirements Dpf Law

Treasurer Tax Collector Monterey County Ca

Prop 218 Benefit Assessment North County Fire Protection District

Orange County Ca Property Tax Calculator Smartasset

Highest And Lowest Property Tax Rates In Greater Boston Lamacchia Realty